Search

The Fischer-Tropsch wax market saw modest gains in July but remained generally stable. However, demand transmission was sluggish, downstream inventories still needed digestion, and related product markets performed indifferently. It is expected that supply-demand game will continue from August to September, with transactions largely driven by rigid demand, leaving ongoing downward pressure on prices.

Prices increased slightly in early July and stabilized in mid-to-late July. The main reasons for the weak price momentum include: although refinery maintenance led to tighter supply and order-based shipments provided some support, high temperatures kept downstream operating rates low. By mid-to-late July, end-users mostly made restock purchases on a need-to basis and focused on digesting existing inventory, resulting in limited procurement enthusiasm. At the same time, the paraffin market—a related product—saw chaotic pricing with some resources offered at discounts or inverted prices, further fueling market caution.

Supply is expected to remain stable in August-September, with domestic major producers operating steadily. Monthly supply is projected to be around 44,000 to 47,000 tons. The market may show a pattern of stronger supply and weaker demand, and some companies may reduce production due to inventory pressure. Although the traditional “Golden September and Silver October” peak season is approaching, demand recovery in sectors like PVC remains slow. While large plants have gradually increased operating rates, small and medium-sized factories continue to face poor order intake. Most downstream users maintain rigid demand purchases, providing limited support to the Fischer-Tropsch wax market.

Trading in the paraffin market remains stagnant, with insufficient demand boost, making it difficult to drive up prices of Fischer-Tropsch wax. Crude oil prices are expected to rise first and then fall, with an overall downward shift in volatility. Downward pressure is likely to increase later.

Market participants remain cautious, with reduced willingness among traders to build inventory and a greater focus on risk control.

Overall, the Fischer-Tropsch wax market has limited room for supply-demand improvement in August-September. With weak bottom support, some products are expected to face downward price pressure.

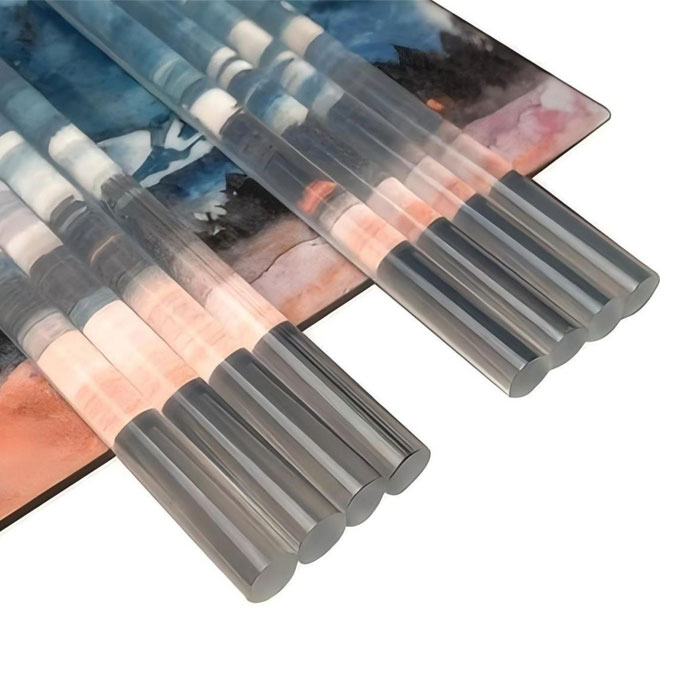

As the Fischer-Tropsch wax market continues to face cautious sentiment and fluctuating demand, securing a reliable partner becomes even more critical. KH Honor Wax provides consistent quality, stable supply, and timely market insights to help you make informed procurement decisions. Contact us today to discuss how we can support your sourcing needs in this uncertain environment.